Double Bottom and Double Top patterns: A Complete Trading Guide

Double Bottom and Double Top patterns: How to Identify and Trade Them

Double Bottom and Double Top patterns: Essential Tools for Technical Analysis

The Double Bottom and Double Top patterns are powerful reversal signals in technical analysis, but they tend to appear under specific market conditions. Let’s examine the scenarios where these patterns typically form and what they indicate about the broader market context.

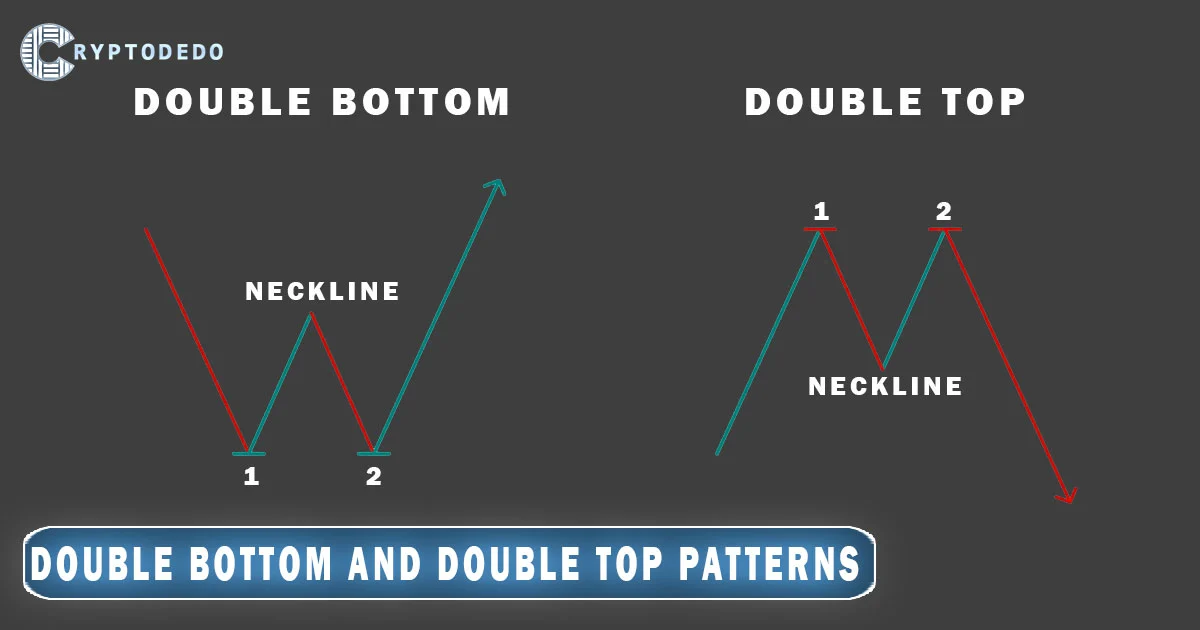

Double Bottom Pattern: Bullish Reversal in a Downtrend

The Double Bottom pattern often emerges during a bearish market or a prolonged downtrend, where prices have been steadily falling. Here’s how the market conditions contribute to the formation of this pattern:

Extended Downtrend: The market has been moving downward for an extended period, leading to oversold conditions. Traders and investors start to feel that the price has dropped too far and is likely to rebound.

First Bottom (Point 1): As the price reaches a significant low, buyers begin to enter the market, believing the asset is undervalued. This creates a temporary upward move.

Pullback to Neckline: The upward move is typically followed by a pullback, where sellers attempt to push the price lower again. This tests whether there’s enough strength in the market to sustain the recovery.

Second Bottom (Point 2): The price again falls to the previous low (or near it) but finds support at the same level. This second bottom indicates that sellers are losing control, and buyers are stepping in with more confidence.

Breakout: When the price breaks above the neckline, it signals the beginning of a bullish reversal. The market sentiment has shifted from bearish to bullish, with traders expecting further price increases.

The Double Bottom usually occurs in the later stages of a downtrend, often when the market is beginning to recover due to positive news, improving fundamentals, or general exhaustion of selling pressure.

Double Top Pattern: Bearish Reversal in an Uptrend

The Double Top pattern is the opposite and forms during a bullish market or a prolonged uptrend, signaling that the uptrend may be nearing its end. These are the typical market conditions for its formation:

Extended Uptrend: The market has been moving upward for a significant period, leading to overbought conditions. Many traders are increasingly cautious as they suspect the price may be too high to sustain further gains.

First Top (Point 1): The price hits a resistance level, where sellers start taking profits or shorting, which causes the price to fall temporarily.

Pullback to Neckline: After the first top, the price pulls back, but buyers quickly push it higher again, reflecting the still-strong bullish sentiment in the market.

Second Top (Point 2): The price reaches the same resistance level a second time, but this time it fails to break through. This second failure suggests that the bullish momentum is fading, and sellers are gaining control.

Breakdown: When the price breaks below the neckline, it confirms the beginning of a bearish reversal. Traders take this as a sign that the market is shifting downward, and they may start shorting or exiting long positions.

The Double Top pattern often appears when a strong bullish run starts losing momentum, and early signs of weakness in the market become evident, such as slowing economic data or negative market sentiment.

While double tops and bottoms are common reversal indicators, traders also rely on similar formations, such as the triple top and triple bottom patterns, for confirmation of trend reversals. To learn more about these variations, check out our detailed guide on Triple Top and Triple Bottom Patterns.

Double Bottom and Double Top patterns : Market Sentiment and External Factors

In both cases, the broader market sentiment plays a crucial role in the formation of these patterns:

Double Bottom tends to appear when fear and pessimism have driven prices lower, but there are emerging signs of optimism or market stabilization.

Double Top forms when greed or over-optimism has pushed prices to unsustainable levels, and traders begin to anticipate a market correction.

External factors such as earnings reports, economic data releases, or geopolitical events can also trigger or accelerate the formation of these patterns, as they shift the market sentiment dramatically.

Conclusion

The Double Bottom and Double Top patterns occur in very different market conditions, with the former signaling a potential bullish reversal after a downtrend, and the latter indicating a bearish reversal after an uptrend.

Understanding the broader market context in which these patterns emerge is crucial for traders to interpret them correctly and to make informed trading decisions. Always combine these patterns with other indicators to confirm the trend reversal and reduce the risk of false signals.