Diamond Pattern in Technical Analysis: A Quick Guide

Diamond Pattern in Technical Analysis: A Complete Guide to Identify and Trade

Diamond Pattern Explained: How to Recognize and Profit from It

Introduction: In the world of cryptocurrency trading, understanding technical patterns is essential for making informed decisions. The Diamond Pattern is one of the rarer chart formations that can provide strong signals of trend reversals.

This pattern can indicate an upcoming bullish or bearish breakout, depending on the direction of the breakout from the diamond shape. In this article, we will explore the Diamond Pattern in detail, including its structure, variations, and how traders can use it to enhance their trading strategies.

To expand your knowledge of trading patterns, you may also find our guide on the Rectangle Pattern and How to Trade It helpful.

What is a Diamond Pattern?

The Diamond Pattern is a reversal pattern that forms during periods of high volatility, creating a structure that resembles a diamond shape on the chart. This pattern usually appears after a prolonged trend and can signal a potential reversal. It is characterized by:

- Broadening: At the start of the pattern, price movements widen, forming a broadening structure.

- Symmetrical Narrowing: The price fluctuations then begin to contract symmetrically, forming a diamond shape.

The Diamond Pattern is more commonly seen at market tops (indicating a bearish reversal) but can also occur at market bottoms (indicating a bullish reversal). Recognizing this pattern can help traders anticipate shifts in the market’s direction.

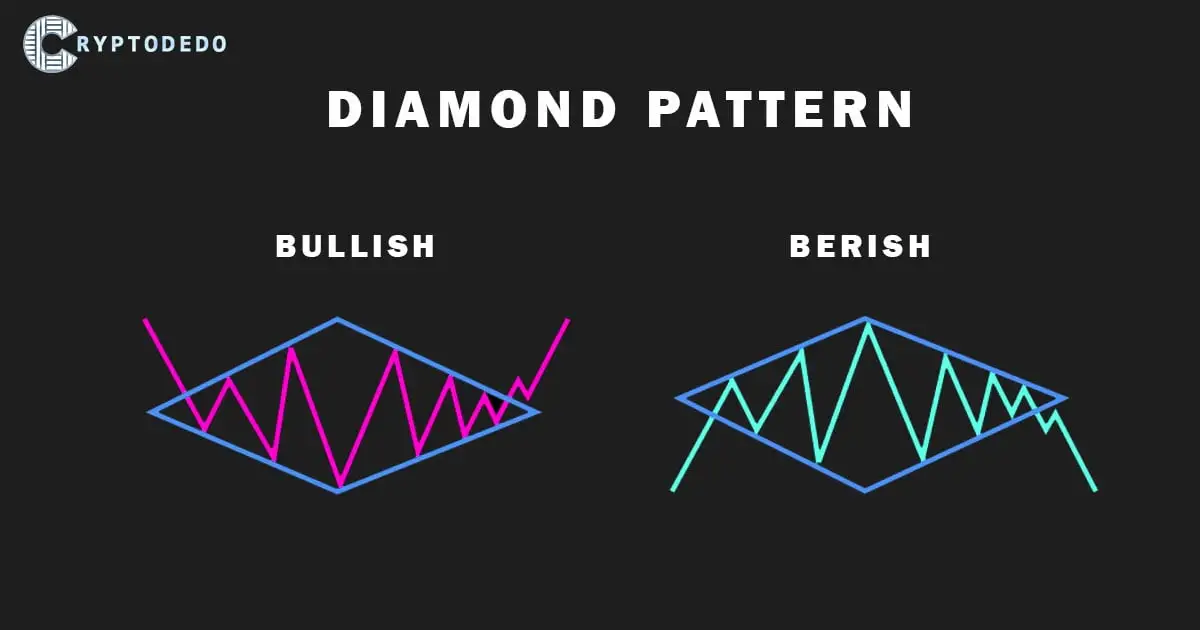

Types of Diamond Patterns: Bullish and Bearish

The Diamond Pattern can lead to either a bullish or bearish breakout, and understanding the difference is crucial for traders.

- Bullish Diamond Pattern

A bullish Diamond Pattern typically forms at the end of a downtrend. The pattern starts with a broadening price structure, where price movements become increasingly volatile. As the structure narrows symmetrically, it forms the diamond shape. A breakout above the upper resistance line indicates a bullish trend reversal.- Interpretation: A bullish Diamond Pattern suggests that the downtrend may be ending, and an upward reversal could be on the horizon.

- Entry Point: Traders might consider entering a long position when the price breaks above the resistance line.

- Stop-Loss: Placing a stop-loss slightly below the recent low can help manage risk if the breakout fails.

- Bearish Diamond Pattern

A bearish Diamond Pattern is commonly found at the end of an uptrend and signals a potential reversal to the downside. It also begins with a broadening structure that contracts into a diamond. A breakdown below the support line suggests a bearish trend reversal.- Interpretation: This pattern indicates that the uptrend may be losing momentum, and a downtrend could be starting.

- Entry Point: Traders might consider short positions when the price breaks below the support line.

- Stop-Loss: A stop-loss above the recent high can help protect against unexpected upward movements.

How to Identify the Diamond Pattern

Identifying the Diamond Pattern can be challenging, as it is rare and requires patience. Here’s a step-by-step guide to help traders spot this pattern:

- Look for a Broadening Structure: Start by identifying a broadening price range, where price highs and lows are increasingly wide.

- Watch for Symmetrical Narrowing: After the initial broadening, the price range should start to narrow symmetrically, forming the diamond shape.

- Confirm with a Breakout: The pattern is confirmed only when the price breaks out from the diamond structure, either above resistance (bullish) or below support (bearish).

Strategies for Trading the Diamond Pattern

Once a Diamond Pattern is identified and confirmed with a breakout, traders can use it to make trading decisions based on the breakout direction:

- Bullish Breakout Strategy

- Entry: Enter a long position when the price breaks above the resistance line.

- Take-Profit: Set a take-profit target based on the height of the pattern (distance from the highest to the lowest point of the diamond) added to the breakout level.

- Stop-Loss: Place a stop-loss slightly below the recent low to manage risk.

- Bearish Breakout Strategy

- Entry: Enter a short position when the price breaks below the support line.

- Take-Profit: Set a take-profit target based on the height of the pattern subtracted from the breakout level.

- Stop-Loss: Place a stop-loss above the recent high to protect against unexpected upward reversals.

Pros and Cons of Trading the Diamond Pattern

Trading the Diamond Pattern has its advantages and limitations, which traders should be aware of.

- Pros:

- Can signal strong reversals, providing high-profit potential when correctly identified.

- Helps traders anticipate market direction after periods of uncertainty.

- Works well in volatile markets, such as the cryptocurrency market.

- Cons:

- Rare occurrence, making it less reliable for frequent trading.

- Can be difficult to identify due to the requirement of precise trendline alignment.

- False breakouts may occur, leading to potential losses if not managed carefully.

Tips for Using the Diamond Pattern in Crypto Trading

- Combine with Other Indicators: To improve accuracy, consider using the Diamond Pattern alongside other technical indicators, such as volume analysis, RSI, or MACD. Increased volume during the breakout often strengthens the signal.

- Risk Management: Always use stop-loss orders to limit potential losses, as the Diamond Pattern is not foolproof and may lead to false signals.

- Practice Patience: Wait for a clear breakout from the diamond structure before entering a trade. Jumping in prematurely can lead to losses if the pattern does not fully form.

Conclusion

The Diamond Pattern is a unique and powerful tool for crypto traders, providing insights into potential trend reversals. While it can be challenging to identify and trade, understanding this pattern can enhance a trader’s ability to capitalize on market shifts.

By using the Diamond-shaped setup in conjunction with other indicators and maintaining proper risk management, traders can make more informed decisions and potentially increase their profitability in the volatile crypto market.