Guide to Bullish and Bearish Candlestick Patterns for Traders

How to Identify Bullish and Bearish Candlestick Patterns in Trading

Understanding Bearish and Bullish Candlestick Patterns in Trading

Candlestick patterns are a crucial part of technical analysis and help traders understand market sentiment and predict potential price movements. In this article, we will explore both Bearish Candlestick Patterns and Bullish Candlestick Patterns used in trading, explaining how they indicate potential reversals or continuations in market trends.

If you’re looking to enhance your trading analysis, exploring Fibonacci trading strategies can provide valuable insights alongside understanding candlestick patterns. Learn how Fibonacci levels and candlestick patterns together can improve your market predictions.

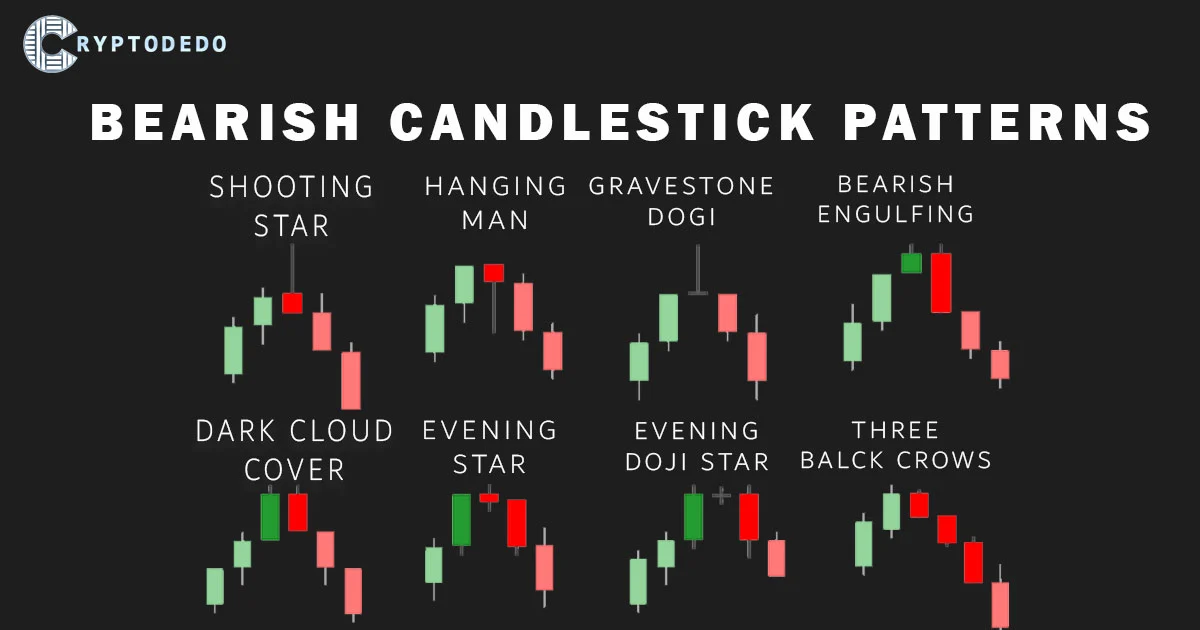

Bearish Candlestick Patterns

Bearish candlestick patterns typically appear at the end of an uptrend and signal that sellers have taken control, potentially leading to a reversal to the downside. Recognizing these patterns can help traders anticipate downtrends and make informed decisions to protect or maximize their positions.

- Shooting Star:

The Shooting Star is a bearish reversal candlestick pattern that often appears at the top of an uptrend. This single-candle pattern is visually characterized by a small body near the lower end of the candle and a long upper wick. The long upper shadow (or wick) shows that buyers initially pushed the price up during the period, but by the close, sellers managed to take control and drive the price back down, leaving a small body and a long upper wick. The pattern resembles a “shooting star” because of its shape, with the body at the bottom and the long wick pointing upwards.

Key Characteristics of the Shooting Star Pattern:

- Small Body:

- The body of the Shooting Star is typically small and is positioned near the lower end of the entire candle’s range. This small body shows that there was little difference between the open and close prices by the end of the period, reflecting indecision or a loss of momentum in the uptrend.

- Long Upper Wick:

- The long upper wick (or shadow) is the most distinctive feature of the Shooting Star. It is at least twice the length of the body, indicating that buyers initially pushed the price up significantly. However, the inability of buyers to maintain this high price suggests that sellers gained strength, pushing the price back down by the close.

- Minimal or No Lower Wick:

- Ideally, a Shooting Star has little to no lower wick. If present, it is very short, emphasizing that the price didn’t fall much below the open or close. This shows that sellers took control primarily in the upper part of the price range.

- Position in an Uptrend:

- The Shooting Star Candlestick pattern is only significant when it appears at the top of an uptrend. In the middle of a trend or at the bottom of a downtrend, it loses its reversal implications. Its appearance in an uptrend indicates a potential shift in market sentiment from bullish to bearish.

What the Shooting Star Pattern Indicates:

The Shooting Star is a bearish signal, suggesting that the recent uptrend could be reaching its end. The Candlestick pattern implies that the buying pressure is weakening, and sellers are gaining strength. The long upper wick reveals that buyers tried to push the price higher, but sellers stepped in and drove the price back down by the close. This price action indicates that bullish momentum is faltering, and a reversal to a downtrend may be on the horizon.

The Shooting Star is most effective as a reversal signal when confirmed by the following:

- High Volume: Increased trading volume on the day the Shooting Star forms adds credibility to the pattern. High volume signifies strong selling interest.

- Additional Bearish Confirmation: Traders often wait for the next candle to confirm the reversal. If the following candle is a bearish one that closes below the body of the Shooting Star, it further validates the bearish reversal.

- Overbought Conditions: If the Shooting Star forms in an overbought market (e.g., high RSI levels), the likelihood of a reversal increases, as the market is more vulnerable to a downturn.

How to Trade the Shooting Star Pattern:

- Entry Point:

- Traders often wait for a confirmation candle after the Shooting Star before entering a short position. The confirmation candle should ideally be bearish and close below the body of the Shooting Star. This confirms that sellers are taking control, signaling a stronger likelihood of a downtrend.

- Setting a Stop-Loss:

- To manage risk, traders usually place a stop-loss order above the high of the Shooting Star. This way, if the price continues to rise instead of reversing, the loss is minimized. The high of the Shooting Star acts as a critical resistance level, and a break above it would invalidate the bearish reversal.

- Profit Target:

- Traders can set a profit target based on key support levels or use technical tools like Fibonacci retracements to determine potential price targets. Some traders aim for a risk-to-reward ratio of at least 1:2 to maximize returns.

- Hanging Man:

The Hanging Man is a bearish reversal candlestick pattern that typically appears at the end of an uptrend. It looks similar to the Hammer pattern, but it appears in an uptrend instead of a downtrend, which gives it a different implication. This pattern is composed of a single candle with a small body near the top and a long lower wick or shadow.

Key Characteristics of the Hanging Man:

- Small Body:

- The small body of the candle reflects a narrow range between the open and close prices, indicating a brief tug-of-war between buyers and sellers. This small body appears near the top of the candle, suggesting that, even though prices fell during the period, they were able to recover by the close.

- Long Lower Wick:

- The long lower wick is the most defining feature of the Hanging Man. It shows that sellers were able to drive the price significantly lower during the period, but buyers stepped in and pushed it back up toward the opening price by the end of the session. This recovery by buyers gives the Candlestick pattern a superficial appearance of strength, but it actually reflects underlying weakness.

- No or Small Upper Wick:

- Ideally, the Hanging Man should have little to no upper wick. This indicates that buyers were unable to push the price much higher than the opening price, highlighting that the buying pressure may be losing strength.

What the Hanging Man Pattern Indicates:

When a Hanging Man forms at the top of an uptrend, it suggests that the bullish momentum may be weakening, as sellers are starting to gain control. The fact that sellers could push the price down significantly before buyers regained control shows that selling pressure is emerging, even if the price ultimately closed near its opening level.

This candlestick pattern can be an early signal that the uptrend might be coming to an end, as the market may be running out of buyers. The Hanging Man alone is not necessarily a strong signal to sell, but it often prompts traders to watch for further confirmation of a potential downtrend.

Confirmation of the Hanging Man Pattern:

The Hanging Man is a potential reversal signal, but it’s typically best used with additional confirmation. Traders often look for the following to confirm the bearish reversal:

- Next Candle is Bearish:

- After the Hanging Man appears, if the next candle is a strong bearish candle (a red or black candle with a close below the Hanging Man’s body), it confirms that sellers are indeed taking control, and the uptrend may be reversing.

- Increased Volume:

- Higher-than-average trading volume during the formation of the Hanging Man indicates that there’s strong participation from sellers, further strengthening the candlestick pattern’s bearish signal.

- Technical Indicators:

- Traders might also look at other indicators like the Relative Strength Index (RSI) to see if the market is overbought. If the RSI indicates overbought conditions and a Hanging Man forms, it can be an even stronger signal of a potential reversal.

Example Scenario of the Hanging Man Pattern:

Imagine a stock that has been trending upwards consistently over several days. After a series of bullish candles, a Hanging Man forms with a small body and a long lower wick. During the day, sellers managed to push the price down significantly, but buyers recovered by the end, closing the price near its opening.

This sudden bearish pressure suggests that the uptrend may be running out of steam. Traders observing this candlestick pattern might consider the possibility of an upcoming downtrend, especially if the next candle opens lower and closes as a strong bearish candle.

Trading Implications of the Hanging Man Pattern:

- Entry Signal:

- Many traders use the Hanging Man as a warning sign rather than an immediate sell signal. If confirmed by the next bearish candle, it may suggest an entry point for short positions.

- Stop-Loss:

- A stop-loss can be set just above the high of the Hanging Man to manage risk. This way, if the price continues upward, the position will be automatically closed, minimizing potential losses.

- Profit Target:

- The profit target for a trade triggered by a Hanging Man can be set at the next support level or based on other technical analysis tools, like Fibonacci retracement levels.

Limitations of the Hanging Man Pattern:

Like all candlestick patterns, the Hanging Man is not foolproof. Some limitations to consider include:

- False Signals:

- Without confirmation from the next candle, the Hanging Man candlestick pattern alone might not indicate a true reversal. Sometimes, the market will continue to rise despite the appearance of a Hanging Man.

- Dependent on Market Context:

- The effectiveness of the Hanging Man depends on the broader market context. In a strong, well-supported uptrend, a Hanging Man might be less reliable than in a weaker uptrend.

- Need for Additional Analysis:

- The Hanging Man should ideally be used in conjunction with other technical analysis tools, such as support and resistance levels, volume analysis, or other candlestick patterns, for better accuracy.

- Gravestone Doji:

The Gravestone Doji is a single candlestick pattern that has a very distinct appearance. It’s characterized by a long upper shadow, no lower shadow, and a very small or nonexistent body, where the open and close prices are almost at the same level and located at the bottom of the candlestick. This pattern is often seen at the top of an uptrend and is considered a strong bearish reversal signal.

How the Gravestone Doji Forms

The Gravestone Doji forms when, during an uptrend, buyers initially push the price up significantly. This buying pressure creates a long upper shadow. However, as the session progresses, sellers begin to enter the market in increasing numbers. They gradually push the price down, erasing the initial gains made by the buyers. By the end of the trading period, the price closes around or at the same level as the opening price, forming a small or nonexistent body at the bottom of the candle.

This price action shows that, despite the early strength from buyers, sellers have taken control by the end of the session. The result is a candle that resembles a gravestone, with the long upper shadow symbolizing the high point reached before the market’s sentiment turned bearish.

Key Characteristics of the Gravestone Doji

- Long Upper Shadow:

- The long upper shadow represents the highest price achieved during the trading period. It indicates that buyers initially drove the price up but could not sustain the momentum as sellers entered the market.

- No Lower Shadow:

- The absence of a lower shadow shows that the closing price was at or very close to the opening price, indicating that sellers managed to bring the price back down entirely, leaving no room for a lower wick.

- Open and Close at the Bottom:

- The open and close prices are located at the bottom of the candle, or nearly the same, showing a complete loss of upward momentum by the end of the session. This lack of movement between the open and close signifies indecision and the shift of control to the sellers.

What the Gravestone Doji Indicates

The Gravestone Doji is generally a bearish reversal candlestick pattern. When it appears at the top of an uptrend, it signifies that the uptrend might be losing strength and that a downtrend could be imminent. It reflects a shift in sentiment from bullish to bearish as sellers have successfully negated the gains made by buyers within the same session.

This candlestick pattern is considered more significant when it appears after a prolonged uptrend or near a key resistance level, where many traders may already be expecting a potential reversal. The Gravestone Doji acts as confirmation that buyers are no longer in control and that selling pressure is mounting.

Trading Implications of the Gravestone Doji

For traders, the Gravestone Doji can be a useful signal to prepare for potential downward movement in the asset. Here’s how traders often interpret and use this candlestick pattern:

- Confirmation is Key:

- Traders generally look for confirmation of the Gravestone Doji’s bearish signal before entering a short position. This confirmation could come in the form of a strong bearish candle immediately following the Gravestone Doji, known as a follow-through candle.

- Entry Point:

- After confirmation, traders may enter a short position with the expectation that the price will decline. The entry point is typically just below the low of the Gravestone Doji or the following bearish candle.

- Stop-Loss Placement:

- A stop-loss can be placed just above the high of the Gravestone Doji. This minimizes risk if the candlestick pattern fails and the price moves upward instead.

- Profit Target:

- Traders often set profit targets at nearby support levels or use other indicators to gauge potential price declines, such as Fibonacci retracement levels.

Example Scenario of the Gravestone Doji

Imagine an asset that has been in a steady uptrend for a few days or weeks. Suddenly, a Gravestone Doji forms at the top of this trend. Initially, buyers push the price significantly higher, but sellers quickly enter, erasing those gains and closing the price near the opening level. This formation suggests that buying momentum may be weakening and that sellers are gaining strength.

After seeing this candlestick pattern, a trader might watch closely for the next day’s candle. If the next candle is bearish, it confirms that the trend may be reversing, and the trader may choose to enter a short position, expecting further downside movement.

Limitations of the Gravestone Doji

While the Gravestone Doji is a strong indicator of a potential reversal, it is not foolproof and should not be relied upon in isolation. Here are some limitations:

- Need for Confirmation:

- A Gravestone Doji alone is not a guarantee of a reversal. It should be used in conjunction with other indicators, such as volume analysis or other technical signals, to increase accuracy.

- Market Context:

- The Gravestone Doji is more reliable when it appears after a prolonged uptrend or near resistance levels. In a choppy or sideways market, the candlestick pattern may have less predictive power.

- False Signals:

- Like all candlestick patterns, the Gravestone Doji can sometimes produce false signals. In such cases, the price may continue to rise instead of reversing, which is why a stop-loss is essential.

- Bearish Engulfing:

The Bearish Engulfing candlestick pattern is a powerful candlestick formation that typically appears at the top of an uptrend or during a period of consolidation, signaling a potential reversal from bullish to bearish momentum. This candlestick pattern is composed of two candles: the first is a smaller bullish candle, followed by a larger bearish candle that “engulfs” the entire body of the previous candle.

Key Characteristics of the Bearish Engulfing Pattern

- Two-Candle Formation:

- The candlestick pattern consists of two candles. The first candle is a bullish candle (usually green or white) that closes higher than its open, indicating buying momentum. The second candle is a bearish candle (often red or black) that opens above or near the close of the first candle and closes below its open, completely engulfing the bullish candle’s body.

- Bearish Candle Engulfs the Previous Bullish Candle:

- For the candlestick pattern to be valid, the body of the bearish candle must entirely cover the body of the previous bullish candle. This shows that sellers have taken over, pushing the price down forcefully and potentially ending the prior uptrend.

- Occurs at the End of an Uptrend:

- The Bearish Engulfing candlestick pattern usually forms after a strong uptrend or rally. It signals that the upward momentum may be weakening and that a reversal to the downside could be imminent.

- Psychological Shift in Market Sentiment:

- The pattern represents a shift in sentiment from bullish to bearish. After a period of buying pressure, sellers come into the market with significant strength, suggesting that buying interest has diminished, and selling pressure is increasing.

What the Bearish Engulfing Pattern Indicates

The Bearish Engulfing pattern indicates that sellers have gained control after a period of buying. The large bearish candle shows that selling pressure is strong enough to completely counter the previous bullish sentiment, suggesting a potential reversal. When traders see this candlestick pattern, it often indicates that the uptrend may be losing steam, and a downtrend could begin.

In essence, the candlestick pattern signals a loss of buyer confidence and a surge in selling pressure. This shift in momentum can lead to further downward movement as other traders recognize the bearish signal and start selling as well.

How to Trade the Bearish Engulfing Pattern

- Confirm the Pattern:

- After identifying a Bearish Engulfing candlestick pattern, traders typically look for additional confirmation to ensure a genuine reversal is likely. Confirmation can come from other technical indicators, such as Relative Strength Index (RSI) showing overbought conditions, or moving averages signaling a trend change.

- Entry Point:

- Traders may enter a short position immediately after the close of the bearish engulfing candle. Alternatively, they might wait for further confirmation, such as a third bearish candle or a break below a nearby support level, to strengthen the bearish signal.

- Stop-Loss Placement:

- A common stop-loss strategy for this candlestick pattern is to place the stop-loss slightly above the high of the engulfing candle. This limits the risk in case of a sudden bullish move and protects against potential losses if the reversal doesn’t hold.

- Profit Targets:

- Profit targets for this candlestick pattern are often set based on previous support levels, Fibonacci retracement levels, or key technical indicators. Traders may also use trailing stops to lock in profits as the price moves in their favor.

Example Scenario of the Bearish Engulfing Pattern in Action

Imagine a stock or cryptocurrency that has been in a steady uptrend, with each new candle closing higher than the last. After a series of bullish candles, a Bearish Engulfing pattern forms, where a large bearish candle completely engulfs the previous bullish candle. This pattern alerts traders that the uptrend might be ending, and a downtrend could be starting.

Many traders who see this candlestick pattern may decide to enter a short position, anticipating further downward movement. As more traders recognize the bearish signal, selling pressure increases, pushing the price even lower. This reinforces the reversal and establishes a new downtrend, confirming the effectiveness of the Bearish Engulfing pattern as an indicator of a trend reversal.

Factors That Strengthen the Bearish Engulfing Pattern

- Volume:

- If the bearish engulfing candle appears with a significant increase in volume, it strengthens the candlestick pattern. High volume indicates that more participants are supporting the bearish move, making it more likely that the reversal is genuine and will continue.

- Overbought Conditions:

- When the candlestick pattern appears after an extended uptrend, especially if other indicators (such as RSI) show overbought conditions, it can be a strong indication that the market is due for a pullback or reversal.

- Trend and Context:

- The Bearish Engulfing pattern is more effective when it appears at the end of a well-established uptrend. If it forms within a range-bound market or consolidation phase, it may not have as much predictive power.

- Market Sentiment and News:

- Fundamental factors or market news can also support the candlestick pattern. If negative news is released around the same time as the Bearish Engulfing pattern appears, it can add weight to the bearish sentiment and increase the chances of a downtrend.

Key Takeaways for the Bearish Engulfing Pattern

- Reversal Signal: The Bearish Engulfing candlestick pattern is primarily a reversal signal, indicating a potential change from an uptrend to a downtrend.

- Confirmation Needed: Although the pattern itself is strong, traders often look for confirmation through other indicators or a follow-up bearish candle.

- Risk Management: Setting a stop-loss above the pattern helps manage risk, and profit targets can be based on support levels or trailing stops.

- Dark Cloud Cover:

The Dark Cloud Cover is a two-candle bearish reversal pattern that often appears at the top of an uptrend, signaling that the bullish momentum may be fading and a potential downtrend could begin. This candlestick pattern is popular among technical analysts as an indicator of a shift in market sentiment from bullish to bearish.

Characteristics of the Dark Cloud Cover Pattern:

- First Candle – Bullish:

- The first candle in the pattern is a strong bullish candle, reflecting continued buying interest. It typically appears in an uptrend, reinforcing the prevailing bullish sentiment and suggesting that the upward movement might continue.

- Second Candle – Bearish:

- The second candle is a bearish candle that opens above the close of the previous bullish candle, indicating initial buying pressure. However, instead of continuing upward, the second candle reverses direction and closes below the midpoint of the first candle. This shows that sellers have taken over, signaling a potential reversal to the downside.

- Gap Up and Close Below Midpoint:

- A key feature of this candlestick pattern is the gap up at the open of the second candle, followed by a close below the midpoint of the first candle. This gap indicates that buyers initially attempted to push prices higher, but strong selling pressure eventually dominated, pushing the price down below the midpoint of the previous bullish candle.

- Volume Confirmation (if applicable):

- If the volume increases on the second bearish candle, it can further validate the Dark Cloud Cover pattern as a potential reversal indicator, suggesting that sellers are committed to pushing prices lower.

What the Dark Cloud Cover Pattern Indicates:

The Dark Cloud Cover pattern represents a shift in market sentiment. While the first candle shows buyer enthusiasm, the second candle demonstrates that sellers have stepped in with enough force to reverse the initial upward momentum. This shift suggests that buyers may be losing control and that the market could be transitioning into a downtrend.

The name “Dark Cloud Cover” is symbolic; it suggests that dark clouds (sellers) are beginning to overshadow the market, potentially leading to “rain” (a downturn). For traders, this candlestick pattern serves as a warning to either exit long positions or prepare for a short opportunity, particularly if other indicators confirm the bearish sentiment.

Trading Implications of the Dark Cloud Cover Pattern:

- Entry Point:

- Traders often wait for further confirmation before entering a short position after spotting a Dark Cloud Cover. This confirmation could be in the form of a third bearish candle, or a close below a recent support level, which would indicate continued selling pressure.

- Stop-Loss Placement:

- A stop-loss can be placed above the high of the second candle or the high of the entire pattern. This helps limit potential losses if the bearish reversal fails and the uptrend resumes.

- Profit Target:

- Traders may set a profit target at the next significant support level or use other technical tools, like Fibonacci retracement levels, to determine an exit point.

Example Scenario:

Imagine a stock or cryptocurrency that has been trending upward with consistent bullish momentum. Suddenly, a large bullish candle appears, reinforcing the uptrend. However, the next day, the price opens above the previous close, creating a gap up. Instead of continuing to rise, the price reverses and closes below the midpoint of the previous bullish candle, forming a Dark Cloud Cover pattern.

This reversal suggests that sellers have entered the market forcefully, taking control away from buyers. Traders observing this pattern may interpret it as a bearish signal and either exit their long positions or initiate short positions, expecting the downtrend to continue.

Key Points to Remember:

- The Dark Cloud Cover pattern is more reliable when it forms after a clear uptrend, as it signals a potential reversal.

- The strength of the candlestick pattern increases if the second candle closes further below the midpoint of the first candle.

- Confirmation with other technical indicators, such as the Relative Strength Index (RSI) showing overbought conditions or high trading volume, can enhance the candlestick pattern’s reliability.

- The gap up at the open of the second candle is essential, as it highlights the initial buying enthusiasm that is eventually overtaken by sellers.

- Evening Star:

The Evening Star is a classic bearish reversal pattern that appears at the top of an uptrend and signals a potential shift from bullish to bearish sentiment. This three-candle formation is widely used by traders to identify the end of an uptrend and the beginning of a downtrend. Here’s a step-by-step breakdown of how this candlestick pattern forms, what it indicates, and how traders can use it effectively.

Structure of the Evening Star Pattern

The Evening Star consists of three candles, each representing a different phase of the market sentiment shift:

- First Candle: Large Bullish Candle:

- The first candle in the Evening Star pattern is a large bullish (green) candle that continues the current uptrend. This candle signifies strong buying interest, with prices closing higher than they opened. This bullish sentiment suggests that buyers are still in control at this stage.

- Second Candle: Small-Bodied Candle (Indecision):

- The second candle is typically a small-bodied candle, which could be bullish, bearish, or even a doji (where the open and close prices are nearly the same). This candle reflects indecision in the market as the buying momentum starts to wane. The small body indicates that neither buyers nor sellers have full control, suggesting that the market is losing its upward momentum.

- Third Candle: Large Bearish Candle:

- The third candle is a large bearish (red) candle that opens below the close of the second candle and closes near the midpoint or lower of the first candle. This strong bearish move confirms the shift in sentiment as sellers take control, driving prices down. This candle typically closes significantly lower than the first candle, signaling a clear reversal.

Interpretation of the Evening Star Pattern

The Evening Star pattern represents a shift in control from buyers to sellers. Here’s what each stage of the candlestick pattern means:

- First Candle (Uptrend Continuation): The large bullish candle suggests that the uptrend is still intact, with buyers pushing prices higher.

- Second Candle (Indecision): The small-bodied candle reflects a balance between buyers and sellers, indicating that the buying pressure is slowing down. This candle can take the form of a doji or a spinning top, both of which are neutral and signal hesitation in the market.

- Third Candle (Bearish Reversal): The large bearish candle completes the candlestick pattern by showing a strong move by sellers. This candle’s downward movement suggests that the trend has shifted, with sellers now gaining control and likely pushing the price lower.

The Evening Star pattern is particularly significant when it appears near a resistance level or when the asset is overbought, as it suggests that the price may struggle to move higher.

Factors to Consider with the Evening Star Pattern

- Volume: Volume plays a crucial role in confirming the Evening Star pattern. Ideally, the volume should increase on the third candle (the bearish candle), showing strong selling interest and a firm shift in market sentiment.

- Location in the Trend: The Evening Star pattern is most reliable when it appears after a prolonged uptrend, indicating that the market may be overextended. If it forms within a range or in a downtrend, it may not have the same predictive power.

- Confirmation: Traders often look for additional confirmation after the Evening Star pattern forms before entering a short position. This confirmation could be in the form of another bearish candle, a break below a support level, or the use of other technical indicators like the Relative Strength Index (RSI) to confirm overbought conditions.

Trading the Evening Star Pattern

Traders use the Evening Star pattern to anticipate a potential downtrend and plan their trades accordingly. Here’s how to approach it:

- Entry Point:

- After the Evening Star pattern completes, traders may enter a short position on the next candle, especially if it is also bearish. Some traders prefer to wait for further confirmation, such as a break below a recent support level, to ensure the reversal is genuine.

- Stop-Loss Placement:

- A stop-loss can be placed above the high of the Evening Star pattern to protect against a potential reversal back to the upside. This helps limit losses if the market does not continue downward as expected.

- Take Profit:

- The profit target can be set at the next major support level or based on other technical analysis tools, such as Fibonacci retracement levels, to estimate potential downside targets.

Example Scenario

Imagine that a stock has been on a steady uptrend, with prices moving higher each day. Suddenly, the Evening Star pattern appears:

- On day one, there is a strong bullish candle, continuing the uptrend and closing near its high.

- On day two, a small-bodied candle forms, showing indecision. The buyers no longer appear as aggressive, and the market closes with little movement.

- On day three, a large bearish candle opens below the previous close and closes significantly lower, erasing much of the gains from the first candle.

This candlestick pattern indicates that the buying pressure has weakened, and sellers are now driving the price lower. Traders observing this candlestick pattern might anticipate further downside movement and consider entering a short position.

Advantages and Limitations of the Evening Star Pattern

Advantages:

- Clear Reversal Signal: The Evening Star is a clear and recognizable pattern, making it relatively easy to identify in charts.

- Effective with Confirmation: When confirmed by volume or other indicators, it can be a reliable signal of an impending downtrend.

Limitations:

- Requires Confirmation: The candlestick pattern itself does not guarantee a reversal, so traders should seek additional confirmation before entering a position.

- Risk of False Signals: In choppy or ranging markets, the Evening Star may produce false signals. It is most effective in trending markets.

- Evening Doji Star:

The Evening Doji Star is a three-candle pattern that appears at the top of an uptrend and signals a potential bearish reversal. This candlestick pattern is similar to the Evening Star, but it includes a doji as the middle candle, which adds a layer of significance due to the doji’s ability to represent market indecision.

Breakdown of the Pattern

- First Candle – Bullish Candle:

- The first candle in the candlestick pattern is a strong bullish candle. It represents the continuation of the uptrend and shows that buyers are still in control of the market. This candle typically has a large body, indicating strong buying momentum.

- Second Candle – Doji Candle:

- The second candle is a doji, which is a candle with a very small or nonexistent body, where the open and close prices are nearly the same. The doji reflects indecision in the market as neither buyers nor sellers are able to dominate. The appearance of the doji after a strong bullish candle is significant because it indicates that the buying momentum is waning, and the market is uncertain about further upward movement.

- Third Candle – Bearish Candle:

- The third candle is a strong bearish candle that closes below the midpoint of the first candle. This candle confirms the bearish reversal as it shows that sellers have taken control after the period of indecision represented by the doji. The strong downward movement indicates that sellers are now pushing prices lower, signaling the beginning of a downtrend.

What the Evening Doji Star Pattern Indicates

The Evening Doji Star pattern is a reliable signal of a potential reversal from an uptrend to a downtrend. Here’s what each part of the candlestick pattern tells us:

- The first bullish candle represents the last strong push of buyers in the ongoing uptrend.

- The doji candle shows that buying pressure is weakening and that the market is at a point of indecision.

- The final bearish candle confirms that sellers have gained control, marking the likely start of a new downtrend.

This candlestick pattern is particularly effective when it appears after a prolonged uptrend, as it shows that the uptrend may be losing steam. The presence of the doji emphasizes the indecision and hints that buyers are losing confidence, which is a key factor in the reversal.

Importance of Volume

While the candlestick pattern itself is often a strong indicator of a reversal, traders may also look at trading volume to confirm the strength of the pattern. Higher volume during the formation of the third bearish candle can provide additional confirmation of the reversal, as it suggests strong selling pressure.

Trading Implications

The Evening Doji Star is a useful pattern for traders looking to capitalize on a reversal in an uptrend. Here’s how traders might approach this candlestick pattern:

- Entry Point:

- Traders often enter a short position (sell) at the close of the third bearish candle, which confirms the reversal. Alternatively, some traders may wait for additional bearish confirmation, such as a break below a recent support level.

- Stop-Loss Placement:

- To manage risk, a stop-loss can be placed above the high of the doji or the first bullish candle, ensuring that any unexpected bullish movement will limit potential losses.

- Profit Target:

- Traders can set profit targets at the next key support level or use technical tools like Fibonacci retracement levels to identify potential exit points.

Example Scenario

Imagine a stock or cryptocurrency that has been in a steady uptrend for several days. After a series of bullish candles, an Evening Doji Star pattern appears:

- The first candle is a large green candle, indicating strong buying pressure.

- The second candle is a doji, suggesting that buyers and sellers are evenly matched, creating uncertainty about further upward movement.

- The third candle is a strong red candle, which closes well below the midpoint of the first candle, signaling that sellers have taken control.

A trader observing this candlestick pattern might decide to short the asset, anticipating that the trend will reverse to the downside, and look to exit at the next support level or based on other technical indicators.

- Three Black Crows:

The Three Black Crows pattern is a bearish reversal candlestick formation that signals a strong shift in market sentiment from bullish to bearish. It consists of three consecutive long bearish candles, each one closing progressively lower than the last, with minimal lower shadows. This pattern is commonly observed after an extended uptrend or near the top of a consolidation period and suggests that sellers have taken control, pushing the price lower each day.

Key Characteristics of the Three Black Crows Pattern

- Three Consecutive Bearish Candles:

- The candlestick pattern is defined by three bearish (red or black) candles. Each candle opens within the previous candle’s body, usually near its close, and then closes lower. This progression of lower closes shows increasing selling pressure.

- Long Candle Bodies:

- Each candle in this candlestick pattern has a relatively long body, which indicates strong momentum in the direction of the downtrend. The long bodies demonstrate that sellers dominated the market during each period, with minimal pushback from buyers.

- Minimal Lower Shadows:

- Ideally, the candles in the Three Black Crows pattern should have small or nonexistent lower shadows (wicks). This characteristic shows that each period ended near its low, indicating sustained selling pressure throughout the trading period.

- Higher Open, Lower Close:

- Each bearish candle opens higher than the previous close but eventually closes lower, showing a gradual decline in price. This setup signals that buyers attempted to regain control at the start of each period but were overpowered by sellers, leading to a continuation of the downward momentum.

Market Psychology Behind the Three Black Crows

The Three Black Crows pattern reflects a significant shift in market sentiment. Here’s what’s happening:

- Previous Uptrend or Consolidation Phase: This candlestick pattern usually appears after a bullish phase or a period of market indecision. When the three consecutive bearish candles form, it signals that the previous buying momentum is weakening, and sellers are taking control.

- Bearish Sentiment Builds: Each of the three candles closes lower than the last, with sellers gaining more control as each trading session progresses. The consistent downward movement suggests that buyers are no longer able to maintain the previous uptrend, and bearish sentiment is now dominating.

- Lack of Buyer Support: Minimal lower shadows on the candles indicate that buyers were unable to push prices up at the end of each trading session, further solidifying the strength of the selling pressure.

What the Three Black Crows Pattern Indicates

The Three Black Crows pattern is a bearish reversal signal that suggests a change in trend direction from bullish to bearish. When this candlestick pattern forms, it often marks the beginning of a downtrend as sellers continue to push the price lower. Traders see it as an indication that selling momentum has increased significantly, overpowering previous buying forces.

For traders, this candlestick pattern is a sign that the uptrend may be ending and a downtrend could be starting. It’s particularly powerful when it appears near a resistance level or when other technical indicators also signal a bearish reversal, such as overbought conditions on the Relative Strength Index (RSI) or a bearish moving average crossover.

Trading Strategies Using the Three Black Crows Pattern

- Confirm the Pattern:

- While the Three Black Crows pattern is a strong bearish signal, traders often wait for confirmation before taking action. This confirmation can come in the form of a fourth bearish candle, a break below a key support level, or additional bearish indicators.

- Enter a Short Position:

- If the pattern is confirmed, traders may consider entering a short position or selling their current long positions. Entering a short trade after the third candle closes can be effective, especially if other indicators align with the bearish outlook.

- Set Stop-Loss Orders:

- To manage risk, a stop-loss order can be placed just above the high of the first candle in the Three Black Crows pattern. This stop level protects traders from potential false signals or unexpected reversals.

- Determine Profit Targets:

- Traders often set profit targets based on nearby support levels or use technical tools like Fibonacci retracements to estimate potential price declines. Setting realistic profit targets is important to secure gains if the downtrend continues.

Example Scenario

Imagine a stock or cryptocurrency that has been in a consistent uptrend. After a period of steady gains, the Three Black Crows pattern forms, with three consecutive long bearish candles appearing one after another. Each candle opens within the body of the previous one and closes progressively lower, indicating a strong downtrend.

Traders observing this candlestick pattern might interpret it as a signal that the uptrend is losing strength. They might decide to exit their long positions or open short positions, expecting that the downtrend will continue based on the candlestick pattern’s formation and the strength of the selling pressure.

Key Takeaways for Bearish Patterns:

- Bearish patterns usually form at the end of an uptrend.

- They signal a potential reversal or continuation of a downtrend.

- These patterns are most effective when confirmed by other technical indicators, such as volume.

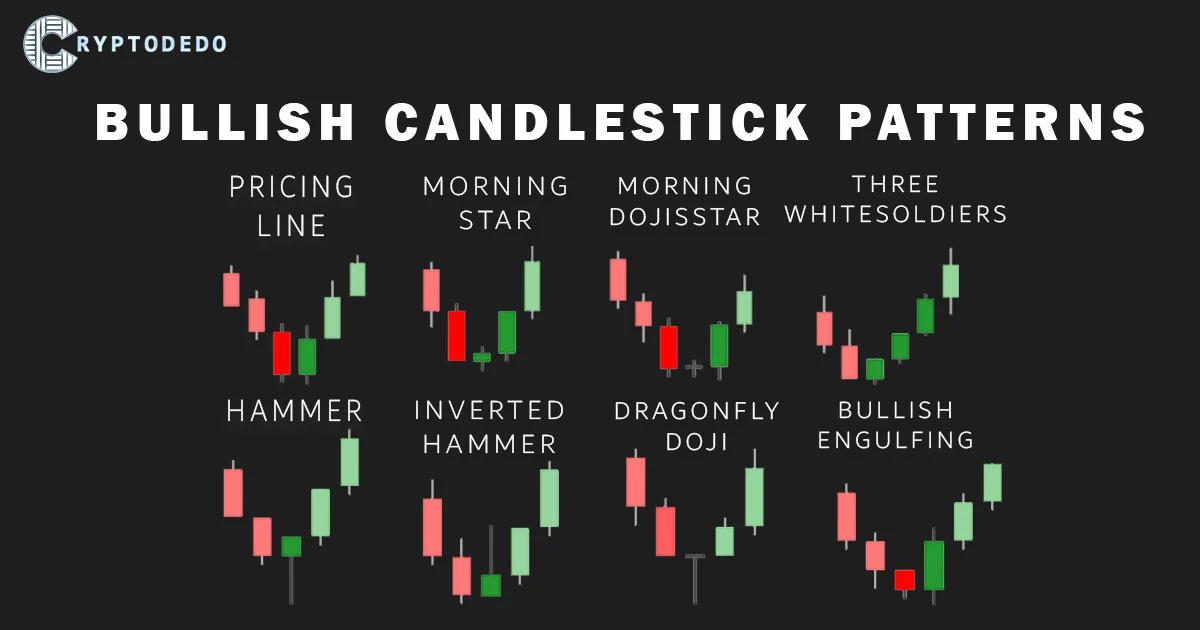

Bullish Candlestick Patterns

Bullish candlestick patterns usually appear at the end of a downtrend and indicate that buyers are gaining control, suggesting a reversal to the upside. Recognizing these patterns can help traders take advantage of emerging uptrends.

- Pricing Line:

The Pricing Line Pattern is a bullish reversal pattern consisting of two candlesticks and often found at the end of a downtrend. This candlestick pattern is highly valuable to traders as it signals a potential change in momentum from bearish to bullish, suggesting that buyers are beginning to gain control over the market. By identifying this candlestick pattern, traders can position themselves to take advantage of an emerging uptrend.

Structure and Components of the Pricing Line Pattern

- First Candle (Bearish Candle):

- The candlestick pattern begins with a bearish candle, which typically appears as a long red (or black) candle, showing strong selling pressure. This candle reflects the market’s previous trend, where sellers have dominated, pushing prices down.

- The bearish candle closes lower than it opens, reinforcing the downtrend’s strength.

- Second Candle (Bullish Candle):

- The second candle in the candlestick pattern is bullish, indicating a potential reversal. It opens below the close of the previous bearish candle, showing that sellers initially still had control.

- However, the bullish candle closes above the midpoint of the bearish candle. This suggests that buyers have not only entered the market but are also gaining enough momentum to push the price up, overcoming the prior selling pressure.

- For this candlestick pattern to be considered strong, the close of the bullish candle should be significantly above the midpoint of the first candle, showing a decisive shift in market sentiment.

Significance of the Pricing Line Pattern

The Pricing Line pattern is significant because it represents a clear shift in market sentiment. After a prolonged downtrend, the appearance of this pattern implies that buyers are beginning to step in, signaling a potential reversal in price movement. It’s essentially a battle between buyers and sellers, where buyers begin to take control from the sellers.

The second candle closing above the midpoint of the first candle is a crucial indicator here. It implies that the downward momentum is weakening and that buying pressure is emerging, which may lead to an uptrend. When traders see this candlestick pattern, they may interpret it as an opportunity to enter a long position, anticipating further bullish movement.

How to Trade the Pricing Line Pattern

- Entry Point:

- Traders typically look to enter a trade at the close of the second (bullish) candle. The idea is to enter the market while the momentum is shifting in favor of buyers, maximizing the potential for profit in an uptrend.

- Stop-Loss Placement:

- A stop-loss can be placed below the low of the first bearish candle in the candlestick pattern. This placement minimizes risk, as a move below this level would suggest that the sellers have regained control and the anticipated reversal may not materialize.

- Profit Targets:

- Profit targets for trades based on the Pricing Line pattern vary based on individual strategies. Some traders may aim for the next key resistance level, while others use risk-reward ratios (e.g., 2:1 or 3:1) to set their profit targets.

- Confirming Indicators:

- To strengthen the reliability of the Pricing Line pattern, traders often look for confirmation through other technical indicators. For example, an increase in trading volume on the bullish candle can add weight to the pattern, as it indicates stronger buying interest. Additionally, traders might use indicators like the Relative Strength Index (RSI) or Moving Averages to confirm the reversal signal.

Example Scenario of the Pricing Line Pattern

Imagine a scenario where a stock or cryptocurrency has been experiencing a downtrend. During this downtrend, a bearish candle forms, closing near the low of the day. The next day, however, a bullish candle appears, opening below the previous close but closing above the midpoint of the bearish candle.

This setup would signal a potential Pricing Line pattern, indicating that sellers are losing strength and buyers are stepping in. A trader recognizing this pattern might enter a long position at the close of the bullish candle, anticipating that the reversal will continue in the days ahead.

Why the Pricing Line Pattern Works

The Pricing Line pattern is effective because it represents a shift in control from sellers to buyers. In a downtrend, sellers are typically in control, and prices tend to make lower lows. When the first bearish candle in this candlestick pattern forms, it continues the trend. However, the appearance of the second bullish candle, which closes above the midpoint of the previous candle, shows that buyers are beginning to overcome the sellers. This change in momentum is a powerful signal that the trend may reverse, making it a valuable pattern for identifying potential entry points.

Limitations of the Pricing Line Pattern

While the Pricing Line pattern can be a useful tool, it is not foolproof. Here are a few limitations to keep in mind:

- False Signals:

- Sometimes, the candlestick pattern can produce false signals, especially in volatile markets. The appearance of a bullish candle does not guarantee a reversal; it could be a temporary pause before the downtrend continues.

- Confirmation Needed:

- For greater accuracy, the pattern should be confirmed with other technical indicators or chart patterns. A Pricing Line pattern alone may not be sufficient to predict a full reversal, especially in strong downtrends.

- Market Context:

- The pattern is most reliable in trending markets. In a choppy or sideways market, it may not provide accurate signals, as price action can be more unpredictable and less driven by trends.

- Morning Star:

The Morning Star is a strong bullish reversal pattern that typically appears at the bottom of a downtrend. It is composed of three candles, each representing a different stage in the shift of market sentiment from bearish to bullish. The Morning Star signals that the sellers have lost control, and the buyers are beginning to take over, suggesting a potential reversal from a downtrend to an uptrend. This pattern is highly regarded by traders as a sign of a possible bullish reversal.

Structure of the Morning Star Pattern

- First Candle – Bearish Candle:

- The first candle in the Morning Star pattern is a long bearish (red or black) candle. This candle continues the existing downtrend and shows strong selling pressure, reflecting the dominance of the sellers in the market. This candle closes lower than its open, reinforcing the downtrend.

- Second Candle – Small-bodied Candle (Doji or Spinning Top):

- The second candle is a small-bodied candle, which can be a doji (where open and close are nearly the same) or a spinning top (a candle with a small body and longer wicks). This candle represents indecision in the market. The small body indicates that neither buyers nor sellers have full control, as the market is uncertain about the next move. This indecision candle suggests that the strong bearish sentiment is weakening, and the downtrend may be losing momentum.

- Third Candle – Bullish Candle:

- The third candle is a strong bullish (green or white) candle that closes higher than the midpoint of the first candle’s body. This candle shows that buyers have taken control, pushing the price significantly higher. The large bullish candle confirms that the trend is likely reversing, with buyers now leading the market.

What the Morning Star Pattern Indicates

The Morning Star pattern signifies a shift from bearish to bullish sentiment. It is most effective when it appears at the end of a sustained downtrend, as it indicates that selling pressure has weakened and buying interest has increased. The candlestick pattern reflects a gradual transition of control from sellers to buyers:

- The first bearish candle confirms the continuation of the downtrend.

- The second candle signals indecision and a potential pause in the downtrend, as neither side has taken full control.

- The third bullish candle confirms that buyers are now in charge, signaling a reversal in the market.

The presence of the Morning Star at the bottom of a downtrend is a sign that the market could be shifting toward an uptrend, making it a reliable signal for traders to look for buying opportunities.

How to Trade the Morning Star Pattern

- Confirmation:

- While the Morning Star is a strong reversal signal, it is generally recommended to wait for additional confirmation before entering a trade. Traders can look for the fourth candle to be bullish or use other technical indicators (such as RSI, MACD, or support/resistance levels) to confirm the bullish reversal.

- Entry:

- A typical entry point is above the high of the third bullish candle. This ensures that the market is continuing to move in a bullish direction and that the reversal is confirmed.

- Stop-Loss:

- A stop-loss can be placed below the low of the second candle (the indecision candle) or below the low of the first bearish candle. This helps limit risk in case the reversal fails and the downtrend resumes.

- Target:

- Profit targets can be set at key resistance levels, such as previous swing highs, or based on technical indicators like Fibonacci retracement levels. Some traders may also set a trailing stop to maximize gains if the uptrend continues.

Example Scenario

Imagine that a cryptocurrency or stock has been in a consistent downtrend, with prices gradually moving lower. Suddenly, a Morning Star candlestick pattern forms:

- The first candle is a long bearish candle, continuing the downtrend.

- The second candle is a small-bodied candle, showing indecision in the market.

- The third candle is a large bullish candle that closes well above the midpoint of the first candle.

This Morning Star formation suggests that the selling pressure is waning, and buyers are starting to gain control. A trader observing this candlestick pattern may enter a long (buy) position with the expectation that an uptrend will follow, especially if other indicators support this reversal.

Important Considerations

- Volume: Higher trading volume on the third bullish candle strengthens the validity of the candlestick pattern. Volume can confirm the intensity of buying interest, making it more likely that the trend will continue upward.

- Location in the Trend: The Morning Star is most effective at the bottom of a clear downtrend. If this candlestick pattern appears in a sideways market or an unclear trend, it may not be as reliable.

- Market Context: It is essential to consider the broader market context and other technical indicators. Using the Morning Star in conjunction with trendlines, moving averages, or support/resistance zones can increase its reliability.

Variations of the Morning Star Pattern

- Morning Doji Star: A variant of the Morning Star pattern where the second candle is a doji, indicating even stronger indecision and a potential for reversal. The Morning Doji Star is considered a more powerful reversal signal due to the presence of the doji.

- Bullish Confirmation: Some traders prefer to see additional bullish confirmation, such as the price closing above a significant moving average (e.g., the 50-day or 200-day moving average) after the Morning Star forms.

- Morning Doji Star:

The Morning Doji Star is a three-candle bullish reversal pattern that appears after a downtrend. It is similar to the Morning Star pattern but includes a doji as the second candle, which represents even greater indecision in the market. This pattern suggests that the downward momentum may be losing steam and that an uptrend might follow.

Structure of the Morning Doji Star

The Morning Doji Star consists of three candles with the following characteristics:

- First Candle (Bearish):

- The first candle is a long bearish candle that continues the existing downtrend. It represents strong selling pressure, indicating that sellers are in control.

- Second Candle (Doji):

- The second candle is a doji, which forms when the open and close prices are very close to each other, resulting in a small or nonexistent body. The doji shows indecision in the market as neither buyers nor sellers can push the price decisively. This pause in the downtrend suggests that the selling pressure may be waning, and a reversal could be imminent.

- Third Candle (Bullish):

- The third candle is a bullish candle that closes above the midpoint of the first bearish candle. This strong bullish candle shows that buyers have taken control, pushing the price higher and signaling a potential reversal to an uptrend.

Psychology Behind the Morning Doji Star Pattern

The Morning Doji Star candlestick pattern reflects a shift in market sentiment from bearish to bullish. Here’s a breakdown of what each candle represents in terms of market psychology:

- First Candle: The long bearish candle shows that the sellers are firmly in control, pushing prices lower as the downtrend continues. This reinforces the bearish sentiment in the market.

- Second Candle (Doji): The doji candle that follows signals a pause in the downtrend. It indicates indecision as the price movement is balanced between buyers and sellers. This suggests that the selling pressure may be weakening, and the market could be at a turning point.

- Third Candle: The strong bullish candle following the doji confirms that buyers are regaining control. This candle’s close above the midpoint of the first bearish candle is crucial as it indicates a shift in sentiment toward bullishness, suggesting that a potential reversal to an uptrend is underway.

How Traders Use the Morning Doji Star

The Morning Doji Star is considered a reliable bullish reversal candlestick pattern, especially when it appears at the bottom of a downtrend. Traders often look for additional confirmation before entering a trade, such as:

- Volume: A higher trading volume on the third bullish candle can strengthen the signal of a reversal, as it suggests increased buying interest.

- Support Levels: If the Morning Doji Star forms near a key support level, it can provide further confidence that the downtrend may be reversing.

- Technical Indicators: Traders may look at other indicators, such as the Relative Strength Index (RSI) or Moving Averages, to confirm that the market is oversold and that a reversal is likely.

Example Scenario

Imagine a stock or cryptocurrency that has been in a steady downtrend. After several bearish candles, a long bearish candle forms, continuing the downward momentum. However, the next candle is a doji, showing that the market is indecisive, and neither buyers nor sellers can push the price significantly in either direction. This doji creates a sense of pause in the market.

On the following day, a strong bullish candle forms, closing above the midpoint of the first bearish candle. This indicates that buyers have taken control, signaling a potential reversal from the downtrend to an uptrend. Traders observing this candlestick pattern might enter a long position, expecting the price to continue upward.

Entry and Exit Strategy

- Entry: Traders typically enter a long position at the open of the next candle after the Morning Doji Star pattern is completed, especially if additional confirmation signals are present.

- Stop-Loss: A stop-loss can be placed below the low of the doji candle to manage risk in case the reversal fails, as this would indicate a continuation of the downtrend.

- Take Profit: Traders can set a profit target based on the next resistance level or use other technical tools like Fibonacci retracement levels to determine an exit point.

Limitations of the Morning Doji Star

While the Morning Doji Star is a strong bullish reversal pattern, it is not foolproof. Some limitations include:

- False Signals: Like all candlestick patterns, the Morning Doji Star can occasionally produce false signals, especially in choppy or sideways markets. It’s essential to confirm the pattern with other indicators or technical analysis tools.

- Requires Context: This candlestick pattern is most effective when it appears at the end of a downtrend. If it appears in the middle of a trend or in a ranging market, it may not be as reliable.

- Time Frame Sensitivity: The effectiveness of the Morning Doji Star can vary depending on the time frame being analyzed. It is generally more reliable on longer time frames (e.g., daily or weekly charts) than on shorter time frames (e.g., hourly or minute charts), where market noise can lead to false signals.

- Three White Soldiers:

The Three White Soldiers pattern is a bullish reversal pattern that appears on candlestick charts and is considered one of the most reliable indicators of a potential trend reversal from bearish to bullish. This pattern consists of three long bullish candles that close progressively higher each day, signaling that buyers are in control and pushing prices upward.

Key Characteristics of the Three White Soldiers Pattern:

- Three Consecutive Bullish Candles:

- The candlestick pattern is defined by three consecutive bullish candles, each opening within the body of the previous candle and closing higher. These candles should ideally have long bodies and short or nonexistent lower shadows, indicating strong buying momentum.

- Higher Closes Each Day:

- Each candle in the pattern closes at a higher price than the previous candle, showing that buyers are continuously gaining strength. This progressive increase in price suggests a shift in market sentiment, with buying pressure increasing each day.

- Small or No Upper Wicks:

- Ideally, the candles have small or nonexistent upper wicks, indicating that prices closed near their highs for each trading session. This characteristic shows that buyers maintained control until the close, without much selling pressure.

- Volume Confirmation (Optional):

- Although not a strict requirement, high trading volume during the formation of the Three White Soldiers pattern can further confirm the strength of the buying pressure. High volume adds weight to the candlestick pattern, suggesting that institutional or large-scale buyers may be driving the trend.

What the Three White Soldiers Pattern Indicates:

The Three White Soldiers pattern is often seen at the end of a downtrend or after a period of consolidation, and it indicates a strong shift in market sentiment from bearish to bullish. This candlestick pattern suggests that buyers have taken control of the market and are likely to continue pushing prices higher. It is often seen as a reliable signal for the start of a new uptrend, especially if confirmed by other technical indicators.

The candlestick pattern also reflects a positive outlook in market sentiment. After a period of selling, buyers have regained confidence, and their sustained effort over three consecutive sessions demonstrates commitment to pushing the market upward. This buying momentum can attract additional traders, further reinforcing the uptrend.

Trading Implications of the Three White Soldiers Pattern:

- Entry Point:

- Traders often consider entering a long (buy) position at the close of the third bullish candle or on the opening of the following candle, expecting the upward momentum to continue.

- Stop-Loss:

- A stop-loss can be placed below the low of the first candle in the candlestick pattern. This level acts as a safeguard in case the market unexpectedly reverses. By placing the stop-loss below the first candle, traders can limit potential losses if the pattern fails.

- Profit Targets:

- Traders may aim for the next significant resistance level as a profit target. This can be a recent high or a level identified through technical analysis tools like Fibonacci retracements or moving averages.

- Confirming Indicators:

- To increase the reliability of this candlestick pattern, traders may look for additional confirmation signals such as moving averages turning upward, increasing volume, or bullish indicators like the Relative Strength Index (RSI) crossing above a certain level (e.g., 50). Such confirmation helps to validate the strength of the uptrend indicated by the Three White Soldiers pattern.

Example Scenario:

Imagine a stock or cryptocurrency that has been in a prolonged downtrend. Over the course of three trading sessions, three large bullish candles appear, each closing higher than the last. This formation marks the Three White Soldiers pattern. The strong buying momentum demonstrated by this candlestick pattern suggests that the downtrend may be over and that a new uptrend is beginning.

Traders observing this candlestick pattern might consider it a signal to enter a long position, betting on the continuation of the uptrend. If additional technical indicators support this signal, they may be more confident in their position.

Important Considerations:

- Overbought Condition:

- After the Three White Soldiers pattern forms, it’s important to check if the asset has reached an overbought condition. The candlestick pattern can sometimes drive prices up quickly, so indicators like the RSI might show an overbought signal (above 70). In such cases, traders might wait for a pullback or consolidation before entering a long position.

- Pattern Reliability:

- While the Three White Soldiers pattern is generally a strong bullish signal, it’s not foolproof. False signals can occur, especially in highly volatile markets. Therefore, it’s wise to use this candlestick pattern in conjunction with other technical analysis tools and not rely on it alone.

- Confirmation:

- Using volume as a confirmation can help validate the candlestick pattern’s strength. Higher-than-average volume on these bullish candles suggests more significant buying interest, making it more likely that the uptrend will continue.

Differences from Other Patterns:

The Three White Soldiers pattern is unique because it reflects sustained buying pressure over multiple trading sessions, which differentiates it from single-candle patterns like the Hammer or two-candle patterns like the Bullish Engulfing. Its strength lies in the consecutive increase in price, which demonstrates a persistent shift in market sentiment rather than a one-time price spike.

- Hammer:

The Hammer is a single-candle bullish reversal pattern that appears in a downtrend. Its name is fitting because it visually resembles a hammer, with a small body at the top and a long lower wick, symbolizing that the market is “hammering” out a bottom.

Key Characteristics of the Hammer Pattern:

- Small Body at the Top:

- The Hammer has a small body located at the upper part of the candlestick. This small body shows that there is a limited difference between the opening and closing prices, indicating that the price didn’t change significantly from the beginning to the end of the session.

- Long Lower Wick:

- The defining characteristic of the Hammer is its long lower wick, which should be at least twice the length of the candle’s body. This lower wick represents a significant drop in price during the session, as sellers initially drove the price down. However, buyers stepped in and pushed the price back up, allowing it to close near the session’s high.

- Little to No Upper Wick:

- Ideally, the Hammer has little or no upper wick, meaning that the price did not go much higher than the open or close. This shows that buyers maintained control until the end of the session, without allowing sellers to push the price down again.

Interpretation and Psychology Behind the Hammer Pattern:

The Hammer is a powerful signal of a potential reversal to an uptrend when it appears in a downtrend. Here’s a look at the psychology behind the candlestick pattern:

- Sellers’ Initial Control:

- At the start of the session, sellers push the price lower, continuing the prevailing downtrend. This drop creates the long lower wick of the Hammer and suggests that bearish momentum is still in play.

- Buyers Regain Control:

- As the session progresses, buyers step in and begin to push the price higher. This buying pressure drives the price back up towards the opening level or higher, forming the small body at the top of the candle. By the close, buyers have effectively neutralized the earlier selling pressure, suggesting that sentiment is shifting in favor of buyers.

- Potential Reversal Signal:

- The Hammer suggests that buyers are gaining strength, and the downtrend may be losing momentum. If followed by a bullish confirmation candle, it can signal the beginning of a reversal to an uptrend.

Confirming the Hammer Pattern:

While the Hammer candlestick pattern is a strong indicator of a potential reversal, it’s generally recommended to wait for confirmation before making a trading decision. Here are some ways to confirm the Hammer pattern:

- Bullish Candle Following the Hammer:

- A strong bullish candle following the Hammer can serve as confirmation of the reversal. This subsequent candle should ideally close above the Hammer’s closing price, confirming that buyers are in control.

- Support Levels:

- If the Hammer appears near a significant support level, it becomes an even stronger signal. The support level reinforces the likelihood that the price will reverse upward.

- Volume Confirmation:

- High trading volume on the day of the Hammer or the confirmation candle can strengthen the signal. Increased volume shows a strong commitment from buyers, reinforcing the likelihood of a reversal.

Trading Strategy Using the Hammer Pattern:

Traders can use the Hammer pattern in several ways, typically focusing on timing entries and setting stop-loss levels to manage risk effectively.

- Entry Point:

- Traders often enter a long position (buy) after the Hammer pattern is confirmed by a subsequent bullish candle. This confirmation indicates that the downtrend may be reversing.

- Stop-Loss Placement:

- A common strategy is to place a stop-loss just below the low of the Hammer’s long wick. Since the Hammer’s wick represents the lowest price reached, placing the stop-loss here minimizes potential losses if the reversal does not occur.

- Take Profit Target:

- The take-profit level can be set at the next resistance level, where the price is likely to face selling pressure. Alternatively, traders can use a trailing stop to lock in profits as the price moves up.

Example Scenario:

Imagine a stock or cryptocurrency that has been in a consistent downtrend. Suddenly, a Hammer candlestick appears, with a small body near the top of the range and a long lower wick. The following day, a bullish candle forms, closing above the previous day’s close. This sequence of candles signals that the selling pressure may be over, and buyers are now in control.

A trader observing this candlestick pattern may decide to enter a long position, placing a stop-loss just below the low of the Hammer. They can then target the next resistance level as a potential take-profit zone.

Hammer vs. Inverted Hammer:

It’s essential to distinguish between the Hammer and the Inverted Hammer. While both patterns indicate a potential reversal, they appear in different market contexts:

- Hammer: Appears in a downtrend and has a long lower wick, signaling a potential reversal to an uptrend.

- Inverted Hammer: Also appears in a downtrend but has a long upper wick, suggesting that buyers are attempting to gain control. The Inverted Hammer still requires bullish confirmation to be reliable.

Summary of the Hammer Pattern:

- Pattern Type: Bullish reversal

- Location: Typically found at the bottom of a downtrend

- Signal Strength: Stronger when confirmed by a subsequent bullish candle and higher trading volume

- Risk Management: Place stop-loss below the low of the Hammer’s lower wick

- Confirmation: Look for a bullish candle or higher volume to validate the reversal signal

The Hammer pattern is a valuable tool in technical analysis for identifying potential reversals in a downtrend. When used with confirmation methods, it can provide a robust signal for entering long positions and taking advantage of upward price movements. However, as with all patterns, traders should combine it with other indicators and risk management techniques to ensure a well-rounded trading strategy.

- Inverted Hammer:

The Inverted Hammer is a single-candle bullish reversal pattern that typically appears after a prolonged downtrend. It is characterized by a small body at the lower end of the candle with a long upper wick or shadow, and little to no lower wick. This candlestick pattern suggests that the market may be at a potential turning point where buyers are beginning to test their strength against the prevailing selling pressure.

Key Characteristics:

- Small Body at the Bottom:

- The small body indicates that there wasn’t much price movement between the open and close within the candle’s time frame. The body usually forms near the low of the session, showing that sellers initially dominated the market.

- Long Upper Wick:

- The long upper wick represents an attempt by buyers to push prices higher during the session, showing that buying interest exists even if sellers are still relatively strong. However, by the end of the session, sellers were able to push the price back down closer to the opening level.

- Little to No Lower Wick:

- The lack of a lower wick or a very short lower wick shows that there was minimal selling below the opening price, suggesting that buyers might be starting to establish a floor or support level at that price.

What the Inverted Hammer Indicates:

The Inverted Hammer candlestick pattern is a sign that buyers are beginning to push back against the downtrend, even though sellers have not been completely overpowered yet. When this pattern appears at the bottom of a downtrend, it may indicate a potential reversal to the upside as buyers test the resistance created by sellers. The upper wick signals that there is upward momentum, which could attract more buyers if confirmed by a strong bullish candle following this pattern.

Psychology Behind the candlestick Pattern:

- During the downtrend, sellers have been dominating, pushing prices lower. However, the appearance of the Inverted Hammer shows that buyers are starting to step in, creating upward pressure.

- The long upper wick indicates that buyers were able to push the price significantly higher at some point, although sellers managed to bring it back down by the close. This battle between buyers and sellers creates a signal that the selling momentum may be weakening.

- The presence of buying interest, even if only temporarily, hints that the market may be close to finding a support level where buyers feel comfortable entering, potentially leading to a trend reversal.

How to Trade the Inverted Hammer candlestick Pattern:

- Confirmation:

- Since the Inverted Hammer itself does not confirm a reversal, traders look for confirmation on the next candle. A strong bullish candle following the Inverted Hammer can provide confirmation that buyers are indeed taking control. This candle should ideally open higher and close above the high of the Inverted Hammer.

- Entry Point:

- After confirmation, traders may consider entering a long position as it suggests that an uptrend may begin. Some traders prefer to place a buy order above the high of the Inverted Hammer to ensure that the market has enough strength to move higher.

- Stop-Loss:

- A stop-loss order can be placed below the low of the Inverted Hammer. This protects against further downside if the reversal fails and the downtrend continues.

- Profit Target:

- The profit target can be set at a key resistance level or based on other technical analysis tools, such as Fibonacci retracement levels. This ensures that profits are locked in as the reversal unfolds.

Example Scenario:

Imagine a cryptocurrency or stock that has been declining for a prolonged period, and traders are anticipating a potential reversal. An Inverted Hammer forms at the end of the downtrend, with a long upper wick indicating that buyers attempted to push prices higher. If a strong bullish candle follows this candlestick pattern, it can confirm the reversal, giving traders confidence to enter a long position with the expectation of a new uptrend.

Important Considerations:

- Volume Confirmation:

- Volume can be a valuable confirmation tool. Higher-than-average volume on the Inverted Hammer can indicate strong buying interest, further supporting the likelihood of a reversal.

- Not Always a Reversal Signal:

- The Inverted Hammer should ideally be confirmed by the next candle before making any trading decisions, as it alone does not guarantee a reversal. If the next candle is bearish, it could mean the downtrend will continue.

- Using Additional Indicators:

- Traders often use other indicators like the Relative Strength Index (RSI) or Moving Averages to confirm the reversal. For example, if the RSI is in oversold territory, it can add weight to the reversal signal.

Key Takeaways:

- The Inverted Hammer signals that buyers are testing the strength of sellers and could indicate a trend reversal if confirmed by the next candle.

- It is often more reliable when it appears at the end of a downtrend and is accompanied by other technical indicators.

- Confirmation from the next candle is crucial, as this candlestick pattern alone does not guarantee a reversal.

- Dragonfly Doji:

The Dragonfly Doji is a unique and powerful candlestick pattern that typically appears at the end of a downtrend, signaling a potential reversal to the upside. It’s characterized by its distinctive shape, with a long lower shadow (or wick) and no upper shadow, indicating that the opening and closing prices are at or near the high of the day.

Structure and Formation of the Dragonfly Doji:

- Long Lower Wick: The long lower wick indicates that sellers initially had control and drove the price down significantly during the trading session.

- No Upper Wick: The absence of an upper wick shows that once buyers regained control, they managed to push the price back up to the opening level, with no further upward movement. This absence of an upper shadow emphasizes the strength of the recovery by the buyers.

- Open and Close at the Top: The open and close are at the same or nearly the same level, forming a horizontal line at the top of the candle. This suggests that by the end of the session, buyers had successfully negated the earlier selling pressure, bringing the price back to where it started.

Interpretation of the Dragonfly Doji:

The Dragonfly Doji reflects a tug-of-war between buyers and sellers. The day starts with sellers pushing prices lower, indicating strong downward momentum. However, as the trading session progresses, buyers step in and start purchasing at the lower prices, driving the price back up to the opening level by the close.

This sharp reversal from a low point to the opening price reflects a shift in sentiment from bearish to bullish. The fact that buyers were able to negate the initial selling pressure and bring the price back up to its opening level suggests that they may be preparing to take control, signaling a possible reversal to the upside.